Types of Customer Due Diligence under MLR 2017

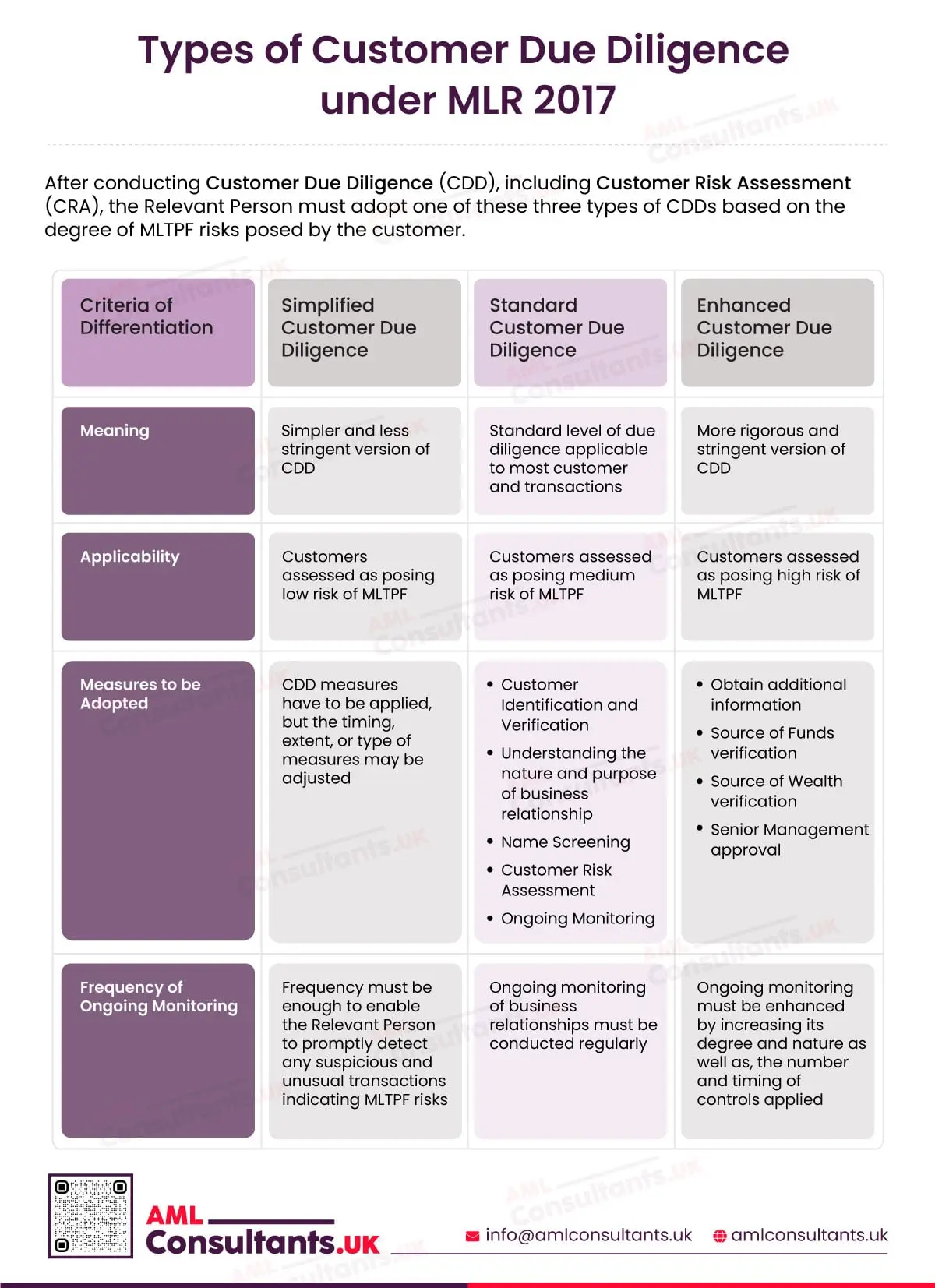

Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 prescribes Relevant Persons to adopt a risk-based approach while implementing their Anti-Money Laundering, Counter-Terrorist Financing, and Counter Proliferation Financing (CPF) Program. A risk-based approach prescribes adopting Customer Due Diligence (CDD) measures based on the degree of Money Laundering, Terrorist, and Proliferation Financing (MLTPF) risks that a customer poses. In this infographic, we have discussed the types of Customer Due Diligence (CDD) applicable to customers based on their MLTPF risk profile.

There are various trigger points that require Relevant Persons to conduct CDD. The Relevant Person must collect necessary information from the customer and understand the degree of MLTPF risks posed by the customer through the Customer Risk Assessment (CRA). This helps create a customer risk profile, based on which the customer can choose the type of CDD it needs to adopt for a customer. The different types of CDD include the following:

Simplified Customer Due Diligence (SCDD)

Meaning: Simplified Customer Due Diligence (SCDD) is a simpler or less stringent version of CDD.

Applicability: It is applicable to customers assessed as posing low risk of MLTPF.

Measures to Be Adopted: Under MLR 2017, the Relevant Person must continue to comply with CDD requirements, but may adjust the time, extent, or type of measures it adopts.

Frequency of Ongoing Monitoring: The frequency of ongoing monitoring of business relationship with the customer must be enough to enable the Relevant Person to promptly detect any suspicious and usual transactions indicating MLTPF risks.

Standard Customer Due Diligence (CDD)

Meaning: Standard Customer Due Diligence (CDD) is the standard level of due diligence applicable on most customer and transactions.

Applicability: CDD is applicable on customers assessed as posing medium risk of MLTPF.

CDD Measures to Be Adopted:

- Customer Identification and Verification:

- Identify the customer, and verify their identity

- For customers that are body corporates, the Relevant Person must determine and verify:

- Its name and address of registered office as well as its principal place of business

- Company number or other registration number

- The law to which it is subject

- Its constitution through documents such as its Articles of Association

- Its board of directors, or an equivalent management body

- The senior persons responsible for its operations

- If the customer is a legal person, such as a company, trust, foundation, etc, information about the customer’s ownership and control structure must also be obtained

- If the customer has beneficial owner(s), the beneficial owner’s identity must also be verified

- If the beneficial owner of the customer is a legal person, Relevant Person must understand their ownership and control structure as well

- It must also identify and verify the identity of any person acting on behalf of the customer, and verify if this person is authorised to act on behalf of the customer

- Understanding the Nature and Purpose of Business Relationship

- Conducting Name Screening: This involves conducting Sanctions Screening, Adverse Media Screening, and Politically Exposed Persons (PEP) Screening

- Conducting Customer Risk Assessment: This includes assessing the level and degree of MLTPF risks posed by the customer

- Ongoing Monitoring: This includes:

- Scrutiny of transactions and ensuring that the transactions are aligned with known information about the customer, and its business and risk profile

- Ensuring that the existing CDD records and information are up-to-date

Frequency of Ongoing Monitoring: Ongoing monitoring of business relationship must be conducted regularly.

Enhanced Customer Due Diligence (ECDD)

Meaning: Enhanced Customer Due Diligence (ECDD) is a more rigorous and stringent version of CDD

Applicability: EDD is applicable to customers that have been assessed as posing high risk of MLTPF

Measures to Be Adopted (in addition to CDD measures)

- Obtaining Additional Information: This additional information includes:

- Customer and its beneficial owner

- Intended nature of business relationship

- Background and reason for transactions

- Verifying Source of Funds

- Verifying Source of Wealth

- Senior Management Approval: This must be sought before onboarding or continuing business relationship with the customer

Frequency of Ongoing Monitoring: Ongoing monitoring must be enhanced by increasing its degree and nature as well as, the number and timing of controls applied.

Types of Customer Due Diligence: Concluding Thoughts

In conclusion, the MLR 2017 establishes a risk-based approach to due diligence, allowing businesses to apply different levels of Customer Due Diligence based on the assessed risk of MLTPF. This ensures that the Relevant Persons prioritise risks and allocate their limited resources in an efficient manner.