Trigger Points for Customer Due Diligence Under MLR 2017

Customer Due Diligence (CDD) is the process through which ‘Relevant Persons’ in the UK identify and verify the identity of their customers, as well as assess the Money Laundering, Terrorist and Proliferation Financing (MLTPF) risks emanating from them.

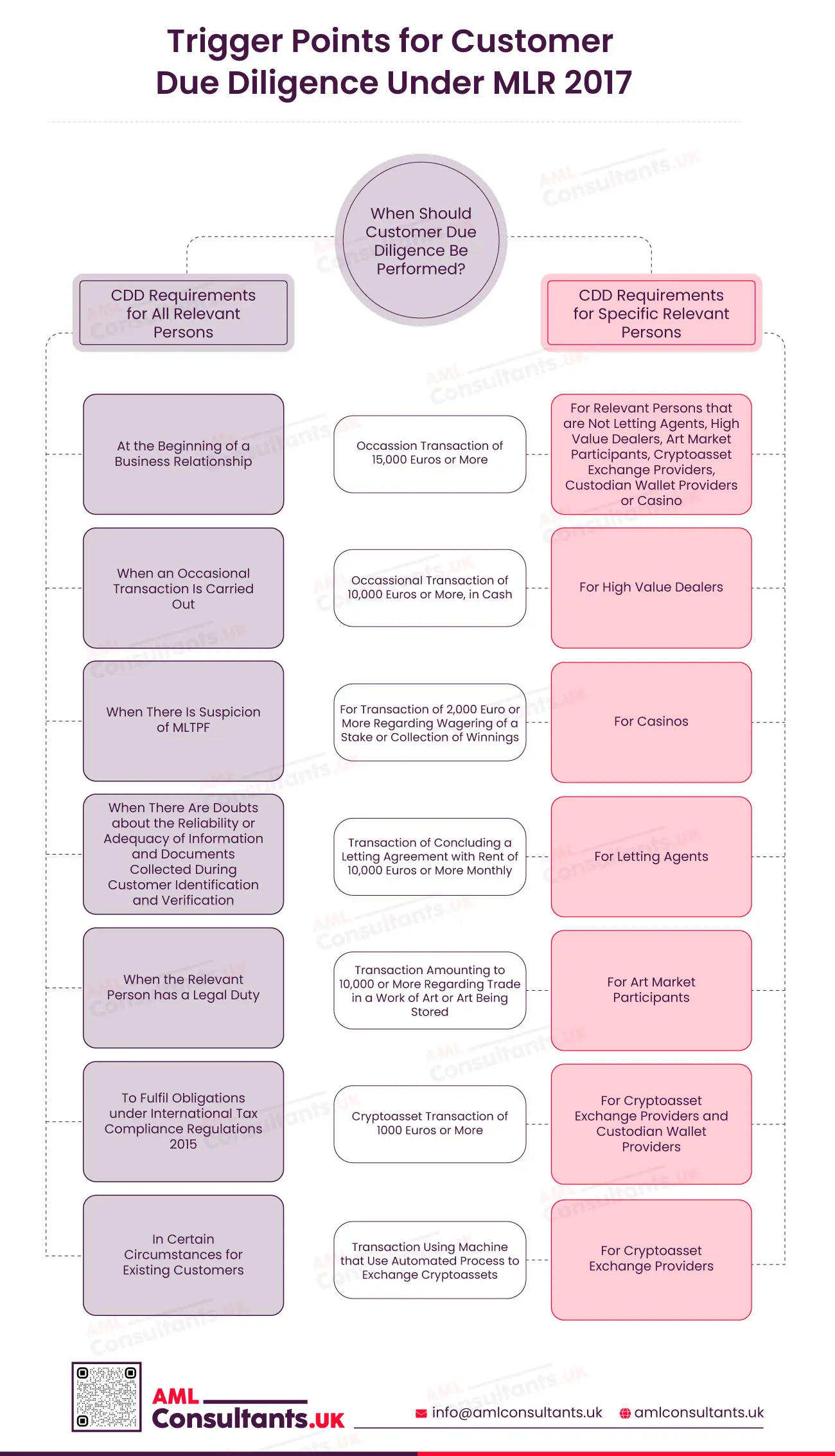

In this infographic, we have discussed the circumstances that trigger the need to conduct CDD, as specified under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017). These circumstances are discussed below.

Trigger Points for Customer Due Diligence Under MLR 2017

At the Beginning of a Business Relationship

CDD must be carried out whenever a Relevant Person establishes a new business relationship with a customer. This helps the relevant person take a risk-based approach to adopting risk control measures while managing MLTPF risks emanating from a customer.

When an Occasional Transaction Is Carried Out:

Whenever a Relevant Person undertakes a transaction which comes under the definition of ‘transfer of funds’ and exceeds 1,000 euros, it must conduct CDD measures for the customer.

A transaction comes under the definition of ‘transfer of funds’ when it meets the definition under Regulation 2015/847/EU of the European Parliament and of the Council. Under this regulation, transfer of funds means transactions that are carried out electronically, at least partially through a payment service provider. This transaction is undertaken on behalf of a payer through a payment service provider, and the funds are transferred to a payee through a payment service provider. The payer, payee, or the payment service providers of the payer and payee can be the same as well. The transactions covered under this definition also include:

- A credit transfer as under Regulation (EU) No 260/2012

- A debit transfer as under Regulation (EU) No 260/2012

- A money remittance, both national or across borders, as under Directive 2007/64/EC

- Transfer through payment card

- Transfer through electronic money instrument

- Transfer through a mobile phone

- Transfer through any other digital, prepaid or postpaid IT devices

When There Is Suspicion of MLTPF:

Whenever a Relevant Person suspects from a customer’s behaviour, activities, transactions, etc., that there is a risk of MLTPF, the Relevant Person must conduct CDD for the customer. This helps the Relevant Person assess their suspicion of the MLTPF risks the customer poses and report the same through the Suspicious Activity Report (SAR).

When There Are Doubts about the Reliability or Adequacy of Information and Documents Collected During Customer Identification and Verification:

Customer Identification and Verification procedures are part of the CDD process. However, whenever a Relevant Person conducts these procedures, they may find that the information or documents they previously collected to verify the identity of the customer are doubtful or inadequate. When this situation arises, CDD must be conducted.

When the Relevant Person has a Legal Duty:

Whenever a Relevant Person has the legal duty to contact an existing customer to review customer-related information with respect to Customer Risk Assessment, specifically beneficial ownership of the customer

To fulfil obligations under International Tax Compliance Regulations 2015:

When a Relevant Person has to reach out to an existing customer to fulfil their requirements under the International Tax Compliance Regulations 2015, it must conduct CDD

In Certain Circumstances for Existing Customers:

CDD must be applied to existing customers of a Relevant Person when:

- It is appropriate to do so on a risk-based approach

- When there is a change in the identity of the customer or their Beneficial Owner

- When the Relevant Person becomes aware that information relevant to Customer Risk Assessment, including the Relevant Person’s assessment of the MLTPF risks with respect to the customer, may have changed.

- When a customer’s transactions are inconsistent with the Relevant Person’s knowledge about the customer

- When there is a change in the nature or purpose of the relationship with the customer

Customer Due Diligence (CDD) Requirements for Specific Relevant Persons

- For Relevant Persons that are not Letting Agents, High Value Dealers, Art Market Participants, Cryptoasset Exchange Providers, Custodian Wallet Providers or Casinos, CDD must be applied when an occasional transaction of 15,000 euros or more is undertaken through a single transaction or in several linked transactions.

- For High Value Dealers, CDD must be applied when carrying out an occasional transaction of value 10,000 euros or more, in cash. CDD must be undertaken whether the transaction is carried out through a single operation or multiple linked transactions.

- For Casinos, CDD must be applied for transactions of value 2,000 euros or more, whether in a single operation or multiple linked transactions, if it is of the following types:

- Wagering of a stake, including purchasing or exchanging tokens for gambling at the casino, payments for gaming machines as defined under the Gambling Act 2005, and depositing funds for remote gambling

- Collection of winnings, including withdrawing funds that were deposited to take part in remote gambling as defined under the Gambling Act 2005, or winnings that have arisen from staking of funds

- For Letting Agents, CDD must be applied when carrying out a transaction which consists of concluding an agreement for the letting of land for a term of a month or more, with rent of 10,000 euros monthly or more for at least part of the term. The CDD must be undertaken for both the person renting the land and the person by whom the land is being let.

- For Art Market Participants, CDD measures must be applied when carrying out a transaction amounting to 10,000 euros or more, with respect to any trade in a work of art or with respect to the storage of a work of art when the Art Market Participant is the operator of a freeport and the value of the work of art being stored is 10,000 euros or more.

- For Cryptoasset Exchange Providers and Custodian Wallet Providers, CDD must be applied when carrying out cryptoasset transfers of 1000 euros in value or more.

- For Cryptoasset Exchange Providers that specifically operate machines that utilise automated processes to exchange crypto assets for money or vice versa, CDD must be applied when transactions are carried out using the machine

Customer Due Diligence Under MLR 2017: Concluding Remarks

Therefore, under MLR 2017, there are many circumstances that require Relevant Persons to conduct CDD for their customers, both new and existing. Relevant persons should stay vigilant about these circumstances to ensure compliance with their AML/CTF/CPF obligations and mitigate any MLTPF risks emanating from their customers.