Navigating through UK's AML/CTF/CPF Regulatory Regime

Navigating through UK's AML/CTF/CPF Regulatory Regime

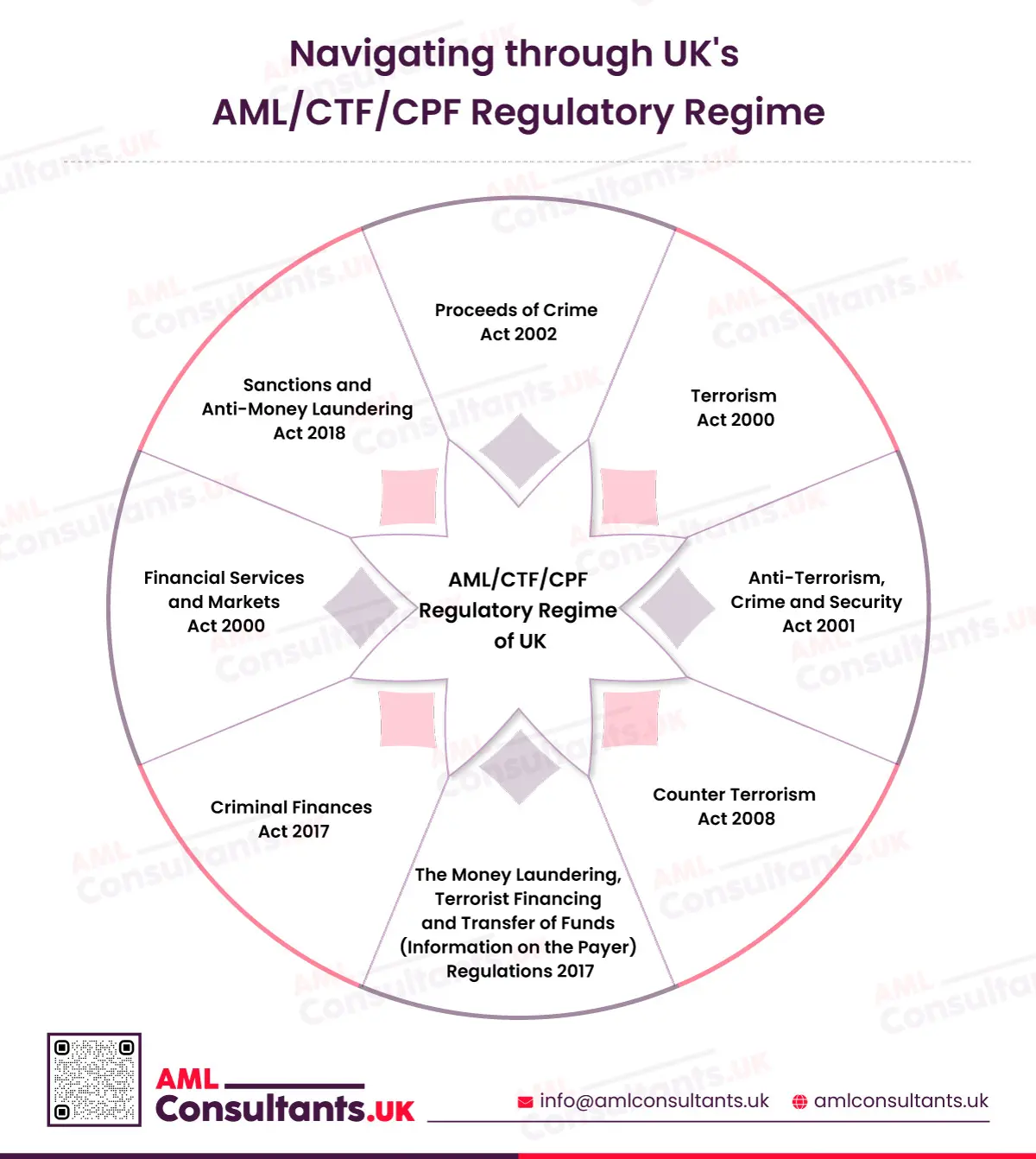

UK's Anti-Money Laundering, Counter-Terrorist Financing, and Counter-Proliferation Financing (AML/CTF/CPF) regulatory regime comprises various legislations. For entities operating in UK, understanding these legislations is essential to ensure compliance and avoid penalties. This infographic discusses the legislations that form a part of the AML/CTF/CPF regulatory regime of UK.

Proceeds of Crime Act 2002 (POCA)

POCA is the principal AML/CTF/CPF law in UK. It covers all crimes dealing with criminal property and provides for its investigation and recovery. It establishes the definition, constituents and penalties for the offence of money laundering. It also provides penalties for failing to report suspicious activity related to money laundering for persons working in the regulated sector, tipping off a person under investigation, destroying evidence, etc

Terrorism Act 2000

Terrorism Act 2002 criminalizes involvement in, facilitating, using and raising money for terrorist activities as well as not reporting any terrorist property or prejudicing an investigation into terrorism.

Anti-Terrorism, Crime and Security Act 2001

This Act empowers investigative agencies to seize or freeze terrorist assets, including those entities operating outside the UK. It also obligates regulated entities to provide information regarding their customers if asked to do so.

Counter-Terrorism Act 2008

This Act empowers His Majesty’s Treasury to publish directions for entities operating in the financial sector and require them to conduct customer due diligence, monitor and report transactions, limit or cease business, etc. These directions are issued when the Financial Action Task Force advises action against a particular country due to terrorist financing, or HM Treasury believes that there exists a risk of the same.

The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017)

MLR 2017 lays down detailed anti-money-laundering and countering the financing of terrorism (AML/CFT) regulations to be implemented by regulated entities as a part of their internal AML/CFT policies, controls and procedures. This prevents the regulated entities from being used as a conduit for these crimes. It involves compliance requirements such as adopting risk management practices, conducting customer due diligence, monitoring and reporting suspicious transactions, record keeping, etc.

Sanctions and Anti-Money Laundering Act 2018

This Act has enabled the UK government to operate its own sanctions framework. Through this Act, the government detects and investigates cases of money laundering and terrorist financing and imposes sanctions on entities or countries related to these crimes. It also provides for enforcement of Standards issued by the Financial Action Task Force (FATF).

Financial Services and Markets Act 2000

This Act enables regulation of the UK’s financial sector. It establishes the Financial Conduct Authority (FCA). One of the responsibilities of the FCA is to supervise the financial sector entities with respect to their AML/CFT compliance requirements. It releases the FCA Handbook, detailing financial conduct mandatory for financial sector entities, including obligations under AML/CFT rules and regulations.

Final Thoughts on UK's AML/CTF/CPF Regulatory Regime

Apart from these laws and regulations, supervisory authorities release guides for the entities they regulate to ensure smooth compliance of the AML/CFT measures. These supervisory bodies include the Financial Conduct Authority, His Majesty’s Revenue and Customs, Gambling Commission, professional body supervisors, etc. These guides are based on the laws and regulations explained through this infographic, which forms the base of the UK’s AML/CFT regulatory regime. By adhering to them, entities can effectively combat the risks associated with money laundering and terrorist financing.