In-house AML Compliance Function Setup

In-house AML Compliance Function Setup

The United Kingdom is experiencing updates and upgrades related to AML regulations, be it the introduction of the Economic Crime and Corporate Transparency Act, 2023 or the latest amendment - The Money Laundering and Terrorist Financing (High-Risk Countries) (Amendment) Regulations 2024, the legislations are getting constantly updated.

The businesses and professions subject to AML compliance need to constantly update relevant internal controls, policies and procedures to ensure implementation of the latest amendments and updates in AML laws. An AML compliance department and the appointment of an appropriate Nominated Officer facilitate businesses in achieving AML compliance. We guide businesses in the UK when it comes to an In-house AML Compliance Department Setup and help them comply with the UK AML regulations.

Timely. Relevant. Compliant.

Transforming you from a reactive approach to a proactive approach with your own In-house AML Compliance Department

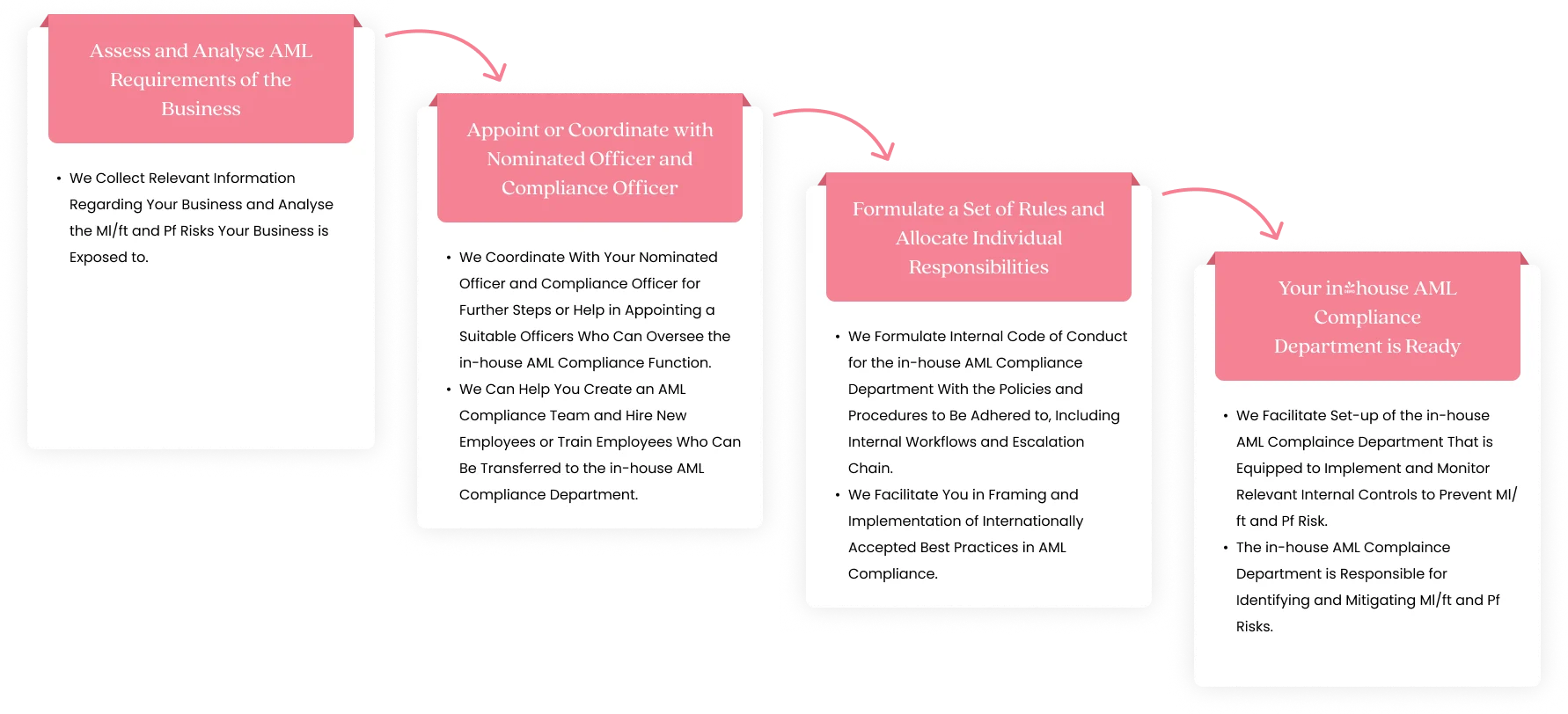

AML Consultants UK process for setting up in-house AML Compliance Department

An AML Compliance Department in a business is responsible for monitoring the implementation of applicable AML regulations as required by the regulatory authorities of a country. The in-house AML Compliance Department is responsible for creating and implementing relevant AML compliance policies.

The in-house AML compliance department ensures that the AML compliance program of the business is managed appropriately, with the Nominated Officer and the Compliance Officer leading the function, monitoring the activities of the department to ensure successful implementation of the AML compliance framework to combat MLTPF.

FAQs In-house AML Compliance Function Setup

I own a business in the UK, so how do I set up an in-house AML compliance department?

You can hire our services of setting up an in-house AML Compliance Department. AML Consultants UK can help you by analysing your businesses’ money laundering, terrorism financing and proliferation financing risk exposure, and creating a compliance team by appointing and adequately training a Nominated Officer and Compliance Officer who can monitor the implementation of AML policies, procedures and controls.

Who and how many should be in the AML Compliance Team?/ What does an AML Compliance team consist of?

An AML compliance team or department needs to take care of ML/FT and PF risk identification, mitigation, monitoring, and reporting. A small-sized business or a sole professional practitioner such as an accountant or a legal services provider can make do with a nominated officer, while an organisation of a large size may be required to recruit people who are competent to carry out the abovementioned functions of the AML compliance team, including a dedicated AML Compliance Officer in addition to a Nominated Officer.