Customer Due Diligence Services

AML Consultants UK provides managed Customer Due Diligence (CDD) Services to help you remain compliant with AML/CTF and CPF regulatory requirements in the UK and optimise compliance costs.

Businesses and professions covered by the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations, 2017 – MLR 2017, find it difficult to onboard adequately skilled AML compliance professionals to carry out routine compliance.

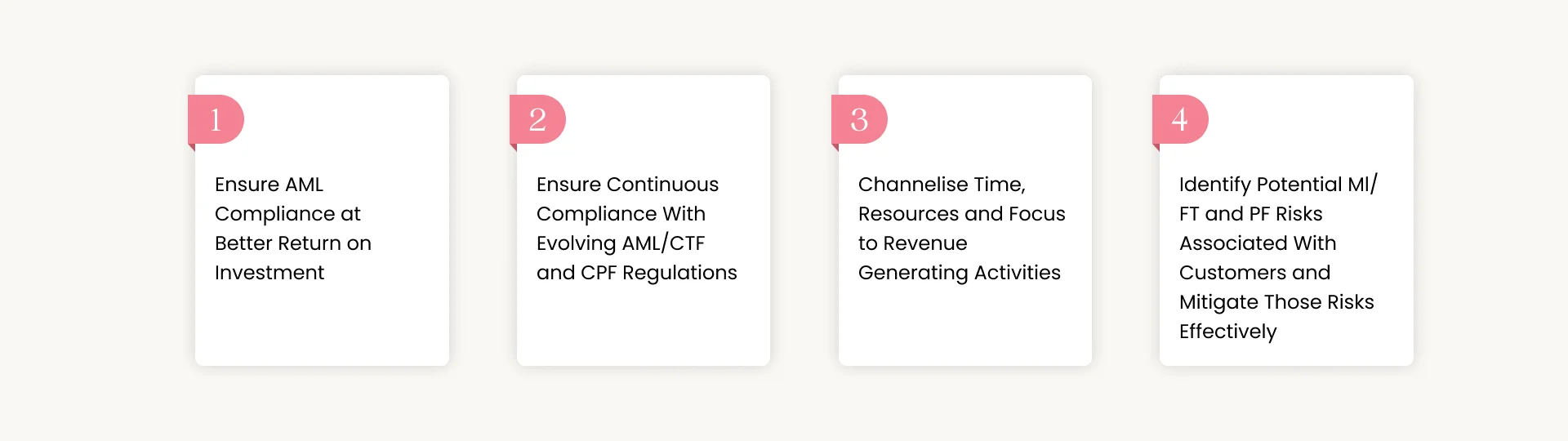

The managed Customer Due Diligence Services help reduce costs and compliance management by facilitating business owners and senior management to channel their focus on their core revenue-generating activities. By capitalising on our managed Customer Due Diligence Services, businesses in the UK can:

Dissemination of Customer Onboarding Kit (Customer Onboarding Policy and Procedure)

Secure Data Acquisition and shared cloud-based repository

Data Processing by experienced CDD Analysts and AML Consultants (Compliance with GDPR and Data Privacy and Protection Policy)

Identification and Communication of data deficiency with client

Identity verification, Sanctions Screening and Customer Risk Assessment

Adequate CDD, including Enhanced Customer Due Diligence

Customer Register Preparation and Review

Prescribing Remedial Measures for Deficiencies

Ensure AML compliance at better Return on Investment

Ensure continuous compliance with evolving AML/CTF and CPF regulations

Channelise time, resources and focus to revenue generating activities

Identify potential ML/FT and PF risks associated with customers and mitigate those risks effectively

Customer Due Diligence Service Methodology

Customer Due Diligence Service Methodology

Dissemination of Customer Onboarding Kit (Customer Onboarding Policy and Procedure)

Secure Data Acquisition and shared cloud-based repository

Data Processing by experienced CDD Analysts and AML Consultants (Compliance with GDPR and Data Privacy and Protection Policy)

Identification and Communication of data deficiency with the client

Identity verification, Sanctions Screening and Customer Risk Assessment

Adequate CDD, including Enhanced Customer Due Diligence

Customer Onboarding Completion and Ongoing Monitoring

Prescribing Remedial Measures for Deficiencies

Customer Register Preparation and Review

Knowledge. Expertise. Teamwork

Ready to transform your compliance, client onboarding & monitoring processes?

Managed CDD Services

Timely. Relevant. Innovative.

Reduce the cost of AML Compliance. Go for our managed CDD Services.

Why AML Consultants for

Customer Due Diligence Services