AML, CTF, and CPF Policies, Controls, and Procedures Documentation

What is an AML, CTF and CPF Policies, Controls, and Procedures manual?

An AML, CTF, and CPF Policies, Procedures, and Control manual is a formally written documentation laying down the policies, controls, and procedures implementing the AML, CTF, and CPF laws and regulations in the UK. The AML policy document is made accessible to the compliance and other relevant staff, and such staff are apprised of their individual roles and responsibilities required for the governance of AML policy. It is also kept up-to-date with the latest legal requirements.

The AML, CTF, and CPF Policies, Controls, and Procedures manual serves as documentation set evidencing the measures the business owner has taken to safeguard the business against financial crimes, including money laundering, terrorist financing, and proliferation financing.

Criminals constantly devise new methods to further their illicit motives, resulting in the advent of newer ML, TF, and PF methodologies and typologies that put businesses in the UK at risk of being used as a conduit by such criminals. Any materialisation of such ML, FT, or PF risk through a business would lead to reputational loss and doubt about the integrity. Therefore, it is essential for businesses to take full control of their processes and operations to avoid any risk of exposure to ML, FT, and PF activities. We provide them with AML policy, controls, and procedures documentation services to help them remain compliant with the AML laws in the UK.

The AML, CTF, and CPF Policies, Controls, and Procedures manual serves as documentation set evidencing the measures the business owner has taken to safeguard the business against financial crimes, including money laundering, terrorist financing, and proliferation financing.

Criminals constantly devise new methods to further their illicit motives, resulting in the advent of newer ML, TF, and PF methodologies and typologies that put businesses in the UK at risk of being used as a conduit by such criminals. Any materialisation of such ML, FT, or PF risk through a business would lead to reputational loss and doubt about the integrity. Therefore, it is essential for businesses to take full control of their processes and operations to avoid any risk of exposure to ML, FT, and PF activities. We provide them with AML policy, controls, and procedures documentation services to help them remain compliant with the AML laws in the UK.

Complete. Consistent. Accurate.

Engage us to create the most suitable AML, CTF, and CPF policies, controls, and procedures for your business.

About

AML Consultants UK

We are an AML compliance services provider with a specific focus on the UK market. Our AML consultants can help you draft AML, CFT, and CPF policies and procedures in line with the business-wide risk assessment and regulatory requirements in the UK.

We provide you with the AML, CTF, and CPF policies, procedures, best practices, KYC, CDD, EDD, and Customer Risk Assessment methodology to streamline your AML compliance journey. We also provide you with thorough training so that you can implement your AML policies and procedures in daily compliance.

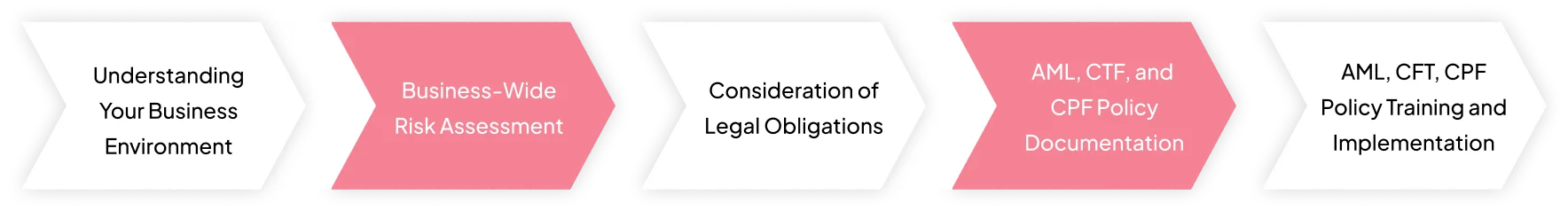

AML, CTF and CPF Policy, Controls,

and Procedures Documentation Process

We create the right policies, rules, and procedures concerning AML, CTF and CPF frameworks for you. Our process of creating appropriate AML, CTF, and CPF frameworks that are right for your business is as follows:

AML, CFT, CPF Policy Training and Implementation

AML, CTF, and CPF Policy Documentation

Consideration of Legal Obligations

Business-Wide Risk Assessment

Understanding Your Business Environment

AML, CTF, CPF Policy, Controls,

and Procedures Documentation Process

We create the right policies, rules, and procedures concerning AML, CTF and CPF frameworks for you. Our process of creating appropriate AML, CTF, and CPF frameworks that are right for your business is as follows:

AML Consultants UK:

Key Differentiators

- As your AML consulting partner, we help you with a frequent assessment of your MLTPF risk mitigation frameworks and policies to guide you appropriately in your various business growth plans, be it expansion, restructuring, or new strategies.

- We have a highly professional team of compliance experts, legal professionals, business analysts, policymakers, AML professionals, and strategic decision-makers to help you understand and navigate the nuances of the MLTPF risks to your business. We help you derive the best AML, CTF, and, CPF strategy to mitigate such risks.

- We have a deep understanding of all the applicable laws, regulations, rules, guidelines, and notifications related to AML, CTF, and CPF in the UK and their interrelation with recommendations issued by the Financial Action Task Force (FATF) to understand their implications and consequences; we utilise this knowledge and vast experience to develop the appropriate AML/CFT policies and procedures for your business operations.

- We also formulate the internal guidelines and manuals for CDD, Sanctions Screening, EDD, and internal SAR reporting workflows to make your internal operations efficient and streamlined to achieve compliance with AML laws. Our AML policy, controls, and procedures documentation service is comprehensive enough to cover each critically important aspect of AML, CTF, and CPF regulation.

- We use internationally standardised best AML compliance practices to create your AML, CTF, and CPF program that can minimise your business’s exposure to criminal elements.

FAQs AML, CTF, and CPF Policy,

Procedures and Controls Documentation

Who needs an AML policy in the UK?

Businesses and Professions in the UK, be they sole practitioners or companies, if they are regulated under anti-money laundering (AML) regulations and subject to AML supervision, must formulate and implement an AML/CTF and CPF policy, procedures, and controls to implement a risk-based approach to prevent money laundering, terrorism financing, and proliferation financing.

Why do businesses in the UK need an AML policy?

What are the core elements of AML Policy in the UK?

The core elements of any AML Policy in the UK are discussed below, on the basis of which a customised AML, CTF and CPF policy is drafted, depending upon the nature and size of the business, the sector and the vertical in which the business operates. The core elements are:

- Appointment, Roles and Responsibilities of a Nominated Officer and Compliance Officer

- Customer Due Diligence (CDD)

- Enhanced Due Diligence (EDD)

- Customer and Business Risk Assessment

- Internal Checks and Controls

- Training and Awareness Programs

- Record-keeping

- Suspicious Activity Reporting at an Internal as well as Regulatory Level

- Senior Management Oversight

- Group Policy Oversight

- Compliance with Financial Sanctions

- Other AML compliances, such as AML audit, Annual Financial Crime Reporting