How to Meet Record-Keeping Obligations Under MLR 2017

How to Meet Record-Keeping Obligations Under MLR 2017

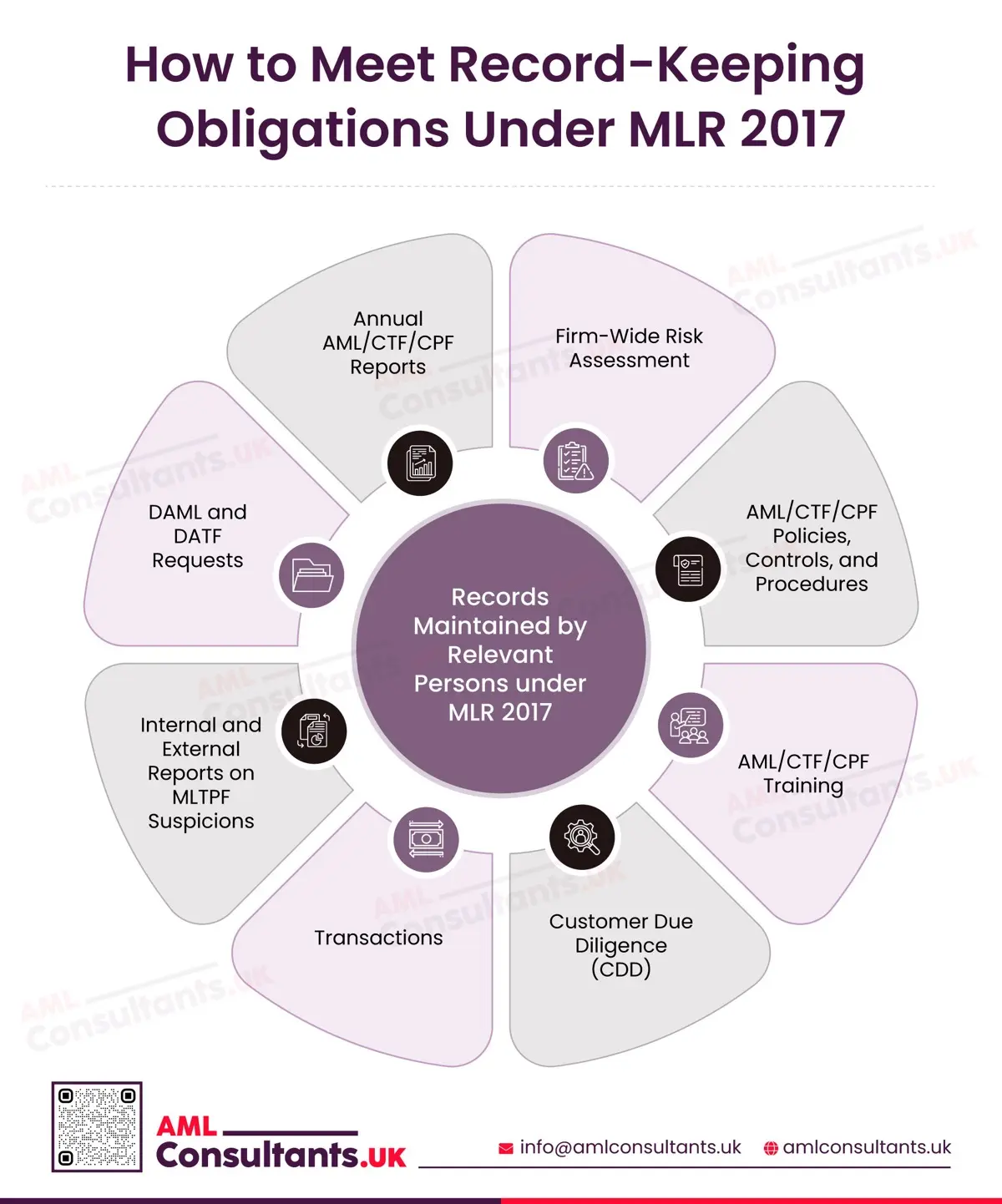

Record Keeping is an important part of a Relevant Person’s obligations under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017). It helps the Relevant Person maintain a thorough audit trail, enabling investigation into a customer or transactions whenever financial crime risks are detected. In this infographic, we will discuss how to meet Record-Keeping obligations under MLR 2017.

Here’s a comprehensive list of records that must be maintained:

Firm-Wide Risk Assessment:

Relevant Persons must ensure that they maintain up-to-date records of their Money Laundering, Terrorist, and Proliferation Financing (MLTPF) Firm-Wide Risk Assessment . This includes keeping a record of all the steps it has taken to identify and assess the risks of MLTPF.

AML/CTF/CPF Policies, Controls, and Procedures:

Up-to-date records of the Relevant Person’s Anti-Money Laundering (AML), Counter-Terrorist Financing (CTF), and Counter-Proliferation Financing (CPF) Policies, Controls, and Procedures must be maintained. As a part of this, the following records must also be kept:

- All changes that are made to the AML/CTF/CPF Policies, Controls, and Procedures during its review and update process

- All the steps that are taken to communicate the AML/CTF/CPF Policies, Controls, and Procedures and changes made to it, within the business of the Relevant Person

- Group-level AML/CTF/CPF Policies, Controls, and Procedures, as well as Policies, Procedures, and Controls for data protection and data sharing to prevent MLTPF with other members of the group. This includes information about the customer, customer accounts, transactions, etc. Records of changes made to them, and steps taken to communicate them to subsidiary undertakings and branches of the Relevant Person must also be maintained.

AML/CTF/CPF Training:

The Relevant Person must maintain records of AML/CTF/CPF training given to employees and agents it uses for the business

Customer Due Diligence (CDD):

Relevant Persons must maintain records of the information and documents collected during the CDD process.

Transactions:

Relevant Persons must maintain records of transactions carried out in the course of the Relevant Person’s business relationship with the customer, including occasional transactions and circumstances where the business relationship has ended for 5 years, and in other cases for 10 years to facilitate the reconstruction of transactions when required.

Internal and External Reports on MLTPF Suspicions:

Relevant Persons must maintain records of the internal reporting of suspicions relating to MLTPF, its investigation, actions taken, and external report, that is, the Suspicious Activity Report (SAR) made to the National Crime Agency (NCA). If external reports are not made, reasons and records that were considered must still be maintained. These should be maintained for five years

DAML and DATF Requests:

Relevant Persons should also maintain records of Defence Against Money Laundering (DAML) or Defence Against Terrorist Financing (DATF) requests, if any.

Annual AML/CTF/CPF Reports:

The Money Laundering Reporting Officer (MLRO) of Relevant Persons must present an annual report to the Senior Management of the Relevant Person, detailing the operation and effectiveness of the Relevant Person’s AML/CTF/CPF compliance processes.

The records mentioned above must be maintained for five years. Further, transaction records are not required to be kept for more than ten years. After these retention periods are over, the Relevant Person must delete the records of personal data obtained unless:

- It is required under any law

- It is required for the purpose of court proceedings

- Consent has been given from the appropriate data subject or person on whom personal data was collected

- The Relevant Person believes that such data is required for the purpose of any legal proceedings

Records Maintained by Relevant Persons under MLR 2017: Way Forward

To ensure effective maintenance and management of records while meeting all their AML/CTF/CPF obligations regarding record-keeping, Relevant Persons should ensure that they make and implement Record Keeping policies and procedures as part of its AML/CTF/CPF Program. Further, record management tools such as software solutions can enhance Relevant Person’s Record Keeping efforts.