Relevant Persons and Their Supervisory Authorities under UK’s AML/CTF/CPF Regulations

Relevant Persons and Their Supervisory Authorities under UK’s AML/CTF/CPF Regulations

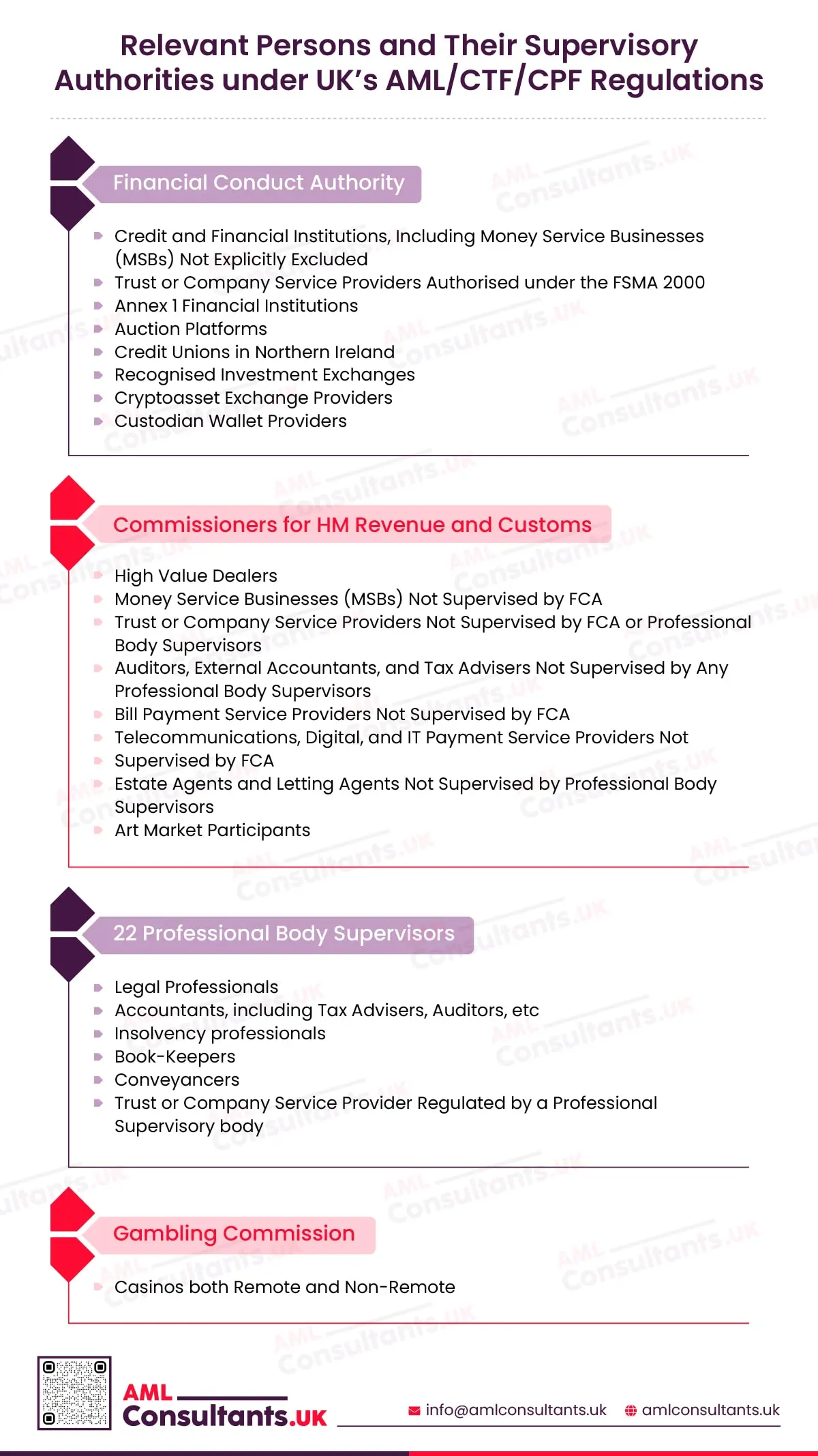

Due to the multiplicity of authorities, it may be challenging to understand which Supervisory Authority supervises what ‘Relevant Person’ under the Anti-Money Laundering, Counter-Terrorist Financing and Counter-Proliferation Financing (AML/CTF/CPF) regulatory regime in UK. This infographic presents this information in a simplified manner.

Under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017), the following Supervisory Authorities oversee and guide ‘Relevant Persons’ in UK:

- Financial Conduct Authority

- Commissioners for His Majesty’s Revenue and Customs

- 22 Professional Body Supervisors

- Gambling Commission

‘Relevant Persons’ are defined under the MLR 2017. The following list enumerates the Supervisory Authorities along with the ‘Relevant Persons’ they regulate.

1. Financial Conduct Authority (FCA) regulates the following Relevant Persons:

- Credit and Financial Institutions including Money Service Businesses (MSBs) not explicitly excluded

- Trust or Company Service Providers (TCSPs) who are authorised persons under the Financial Services and Markets Act, 2000 (FSMA 2000). Authorised persons are those that are permitted under the FSMA 2000 to carry out regulated activities such as accepting deposits, issuing electronic money, carrying out contracts of insurance, dealing in investments, etc

- Annex 1 Financial Institutions that provide services such as:

- Lending including, among others, consumer credit, credit agreements relating to immoveable property, financing of commercial transactions, etc

- Financial leasing

- Providing payment services

- Offering guarantees and commitments

- Trading for own account or for account of customers in money market instruments, foreign exchange, financial futures and options, exchange and interest-rate instruments or transferable securities

- Safe custody services

- Money broking

- Portfolio management advice

- Safekeeping and administration of securities

- Participation in securities issues and providing services related to these issues

- Providing advice to undertakings on capital structure, industrial strategy and related questions and advice and services relating to mergers and the purchase of undertakings

- Auction Platforms

- Credit Unions in Northern Ireland

- Recognised Investment Exchanges under FSMA 2000

- Cryptoasset Exchange Providers

- Custodian Wallet Providers

2. Commissioner for His Majesty’s Revenue and Customs regulates the following Relevant Persons:

- High value dealers

- MSBs not supervised by the FCA

- Trust or Company Service Providers not supervised by FCA or any Professional Body Supervisors

- Auditors, external accountants, and tax advisers not supervised by any Professional Body Supervisors

- Bill payment service providers not supervised by the FCA

- Telecommunications, digital, and IT payment service providers not supervised by FCA

- Estate agents and letting agents not supervised by Professional Body Supervisors

- Art Market Participants

3. There are 22 Professional Body Supervisors under the MLR 2017. These are:

- Association of Accounting Technicians

- Association of Chartered Certified Accountants

- Association of International Accountants

- Association of Taxation Technicians

- Chartered Institute of Legal Executives

- Chartered Institute of Management Accountants

- Chartered Institute of Taxation

- Council for Licensed Conveyancers

- Faculty of Advocates

- Faculty Office of the Archbishop of Canterbury

- General Council of the Bar

- General Council of the Bar of Northern Ireland

- Insolvency Practitioners Association

- Institute of Certified Bookkeepers

- Institute of Chartered Accountants in England and Wales

- Institute of Chartered Accountants in Ireland

- Institute of Chartered Accountants of Scotland

- Institute of Financial Accountants

- International Association of Bookkeepers

- Law Society

- Law Society of Northern Ireland

- Law Society of Scotland

These bodies regulate the legal and accountancy professionals with respect to their AML/CTF/CPF obligations. These include:

- Auditor

- External accountant

- Insolvency practitioner

- Tax adviser

- Trust or Company Service Providers

- Lawyers

- Advocates

- Barristers

- Legal Executives

4. Gambling Commission

The Gambling Commission supervises both remote and non-remote casinos.

Conclusion

Therefore, in UK, several Supervisory Authorities regulate different sets of relevant persons under the AML/CTF/CPF regulatory regime. Understanding which Supervisory Authority regulates them can help Relevant Persons ensure proper compliance with the UK’s AML/CTF/CPF regulatory obligations.